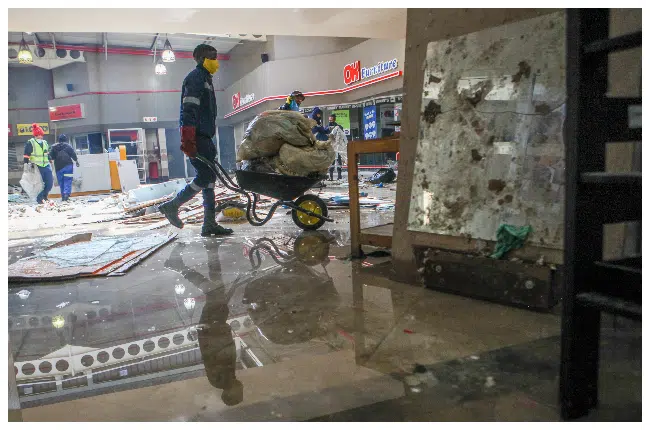

Closed for business — many companies without special insurance won’t survive the looting

Insurance business will feel the pinch as services begin to restore. Picture: Gallo Images/Sharon Seretlo

Insurance business will feel the pinch as organizations begin to reconstruct. Image: Gallo Images/Sharon Seretlo Turmoil. That’s how the last couple of days in South African might be explained in one word. Shopping malls have actually been set on fire, company robbed and tasks lost in 3 provinces. Ever since, we have actually seen neighborhoods unite to attempt to protect their homes and companies, as the cops and army stopped working to bring back calm. More soldiers were hired, however it is far too late for lots of.

The damage has actually been done. Individuals have actually passed away, home has actually been damaged, products robbed, and services interrupted – all in demonstration of previous President Jacob Zuma’s arrest.

The expense of one week’s demonstration is most likely to face billions of rands and this will impact everybody in both the long and short-term. Fuel and food lacks are currently upon us, with some individuals declaring they are robbery due to the fact that they can’t get food any other method. Important services, like the Covid-19 vaccination websites, have actually been closed down. The rand has actually been struck hard, financier self-confidence trashed, and more task losses will likely follow.

Lots of services have actually been required to close and for some, this might be a long-term thing. Little setups that can’t manage insurance coverage will get no payment. They will be delegated get the pieces and begin once again– if they can.

Find out more| We will restore – KwaZulu-Natal hair salon owner ravaged after service robbed

For those that can pay for insurance coverage, some support might be upcoming. However just if they have extra cover with the state-owned insurance provider Sasria (South African Special Risk Insurance Association).

Sasria is the only short-term insurance company that offers protection for damage triggered by unique threats such as politically inspired destructive acts, riots, strikes, terrorism and public conditions. The business’s origins go back to the 1976 Soweto uprisings, when the insurance coverage market started to understand the high dangers included with covering losses from such discontent.

This implies that companies that do not have extra protection with Sasria will not be spent for claims by their insurance companies. And it might spell completion of lots of little business that supply tasks and important services to neighborhoods.

” There are countless small companies that do not purchase Sasria cover,” Sasria MD, Cedric Masondo informed Business Maverick.

” Most companies in municipalities do not have Sasria cover. Some do not have any kind of insurance coverage and will not have the ability to recuperate from losses or damages.”.

Sasria is not required to cover all claims even if it is a state-owned business.

” There is a misunderstanding that Sasria has a chequebook that would simply pay claims from everyone. That is not real,” Cedric informed Fin24.

Even if services do have this extra safeguard, it is restricted. Sasria’s main cover, or basic policy, guarantees possessions as much as R500 million. Its so-called wrap cover for customers wishing to guarantee high-value properties over this quantity uses an extra cover of R1 billion. So even with the greatest cover, a service can not declare for losses above R1.5 billion.

Due to the existing discontent, Sasria is now dealing with enormous payments. Cedric has actually offered an approximated figure of a minimum of R7 billion.

Sasria ensured their customers that they are liquid and prepared to honour claims as they are available in with the expectation of more claims being lodged.

” We keep in mind of the unpredictability around the metrology of the losses or damages that have actually arised from the present discontent. At this phase we do not understand the amount of Sasria declares as an outcome of these riots as many claims have actually not been reported and a lot of are still being examined by the Loss Adjusters. We expect that in about 2 months’ time, we will have a clearer photo as soon as all claims have actually been reported and examinations and metrology have actually been finished,” they stated in a declaration.

South Africa’s biggest short-term insurance company, Santam informs Drum it’s worried about the discontent that’s grasping the nation.

” We are especially distressed by the death. We are likewise worried about the damage of home and its effect on incomes. These occasions might have long-lasting ramifications on financier self-confidence and the expense of insurance coverage,” states head of business interactions, Thabo Mabaso..

He validates that unrest-related claims of this nature are usually covered by Sasria and in order for a customer to claim for such occasions, they ought to have picked Sasria cover under their insurance coverage with their insurance company.

” By close of service on 14 July 2021, Santam had actually signed up 21 motor and 167 non-motor Sasria claims. At this phase we are not able to supply a financial quantity for these claims as the loss adjustors should still identify the level of the loss for each claim..

” Santam is keeping track of the scenario carefully and engaging with Sasria to guarantee that these claims are managed as rapidly as possible. Santam Re [its reinvestment arm] has a little involvement portion on the Sasria reinsurance program however it is prematurely to measure any possible direct exposure of this involvement.”.

The very best thing for afflicted organizations– and individuals and economy of the nation as a whole– is for the repair of order as quickly as possible.

Cedric informed Fin24 Sasria has the funds to pay the claims up until now, as long as the rioting and robbery does not continue for too long.

” There’s no business that can pay R2 billion every day,” he stated.