Major headache for airlines in South Africa after oil refinery closures

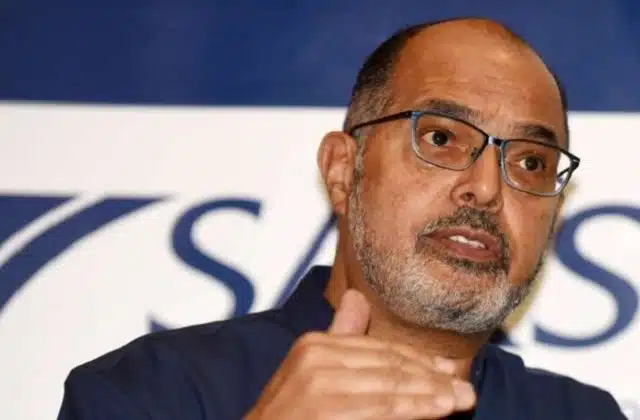

South Africa’s airlines could face shortages of necessary jet fuel supplies after the country’s oil refinery closures, says Tseliso Maqubela, deputy director for the Department of Mineral Resources and Energy.

Earlier this week, Sasol declared force majeure on the supply of petroleum products due to delays in crude oil deliveries to its Natref refinery – leaving the country without any operational oil refineries.

Sasol said that with the 108,000 barrel-a-day plant being forced to stop, the company would not be able to fully meet its commitments on the supply of all petroleum products from July 2022.

Speaking to CapeTalk, Maqubela said that the department does not expect diesel and petrol to be significantly affected; however, it is concerned about the impact this will have on the availability of jet fuel for airports.

Natref was one of the main suppliers to OR Tambo airport in Johannesburg. Usually, when Natref is not operational the department can rely on sufficient jet fuel stock, he said.

Due to the closure of Natref being unexpected, the department alongside Sasol will assess the impact the closure will have on airlines as well as how much jet fuel stock is available.

Sasol said that Natref should be up and running by the end of July; however, the department is concerned about what the next two weeks have in store for the airline industry.

“As of last week, we were comfortable, if this refinery is coming back on line end of July, what happens in the next two weeks,” said Maqubela.

Maqubela said that this is happening as a result of turbulent global markets where crude oil inbound for Sasol was supposed to come from Nigeria but was redirected to North America, leaving the domestic refinery without oil.

Bloomberg provided the following breakdown of how many barrels the country’s oil refinery used to produce, showing the significant loss in production:

Sapref, the most productive refinery has been out of service since severe flooding in KwaZulu-Natal and is still reeling from the damage.

Maqubela added that oil refineries are likely to take a while to come back online with the example of PetroSA in Mossel Bay being out until late 2023 and Engen’s refinery Enref being converted to an import terminal.