Reserve Bank warns of ‘price spiral’ in South Africa

The South African Reserve Bank (SARB) warns that above-inflation wage negotiations could lead to price-spiral and a tighter monetary policy in the country.

Speaking on Wednesday (17 August) at a standing committee on finance, the SARB’s deputy governor Kuben Naidoo said that the bank is starting to see wage increases being pegged above inflation target ranges – which is worrying.

“If salary increases are not compensated for by productivity gains, then that does lead to inflation, and that would require a stronger monetary policy response,” said Naidoo.

He said that South Africa has seen rising food and fuel prices combined with rising core inflation which could lead to broad-based inflation that is damaging to households and household income.

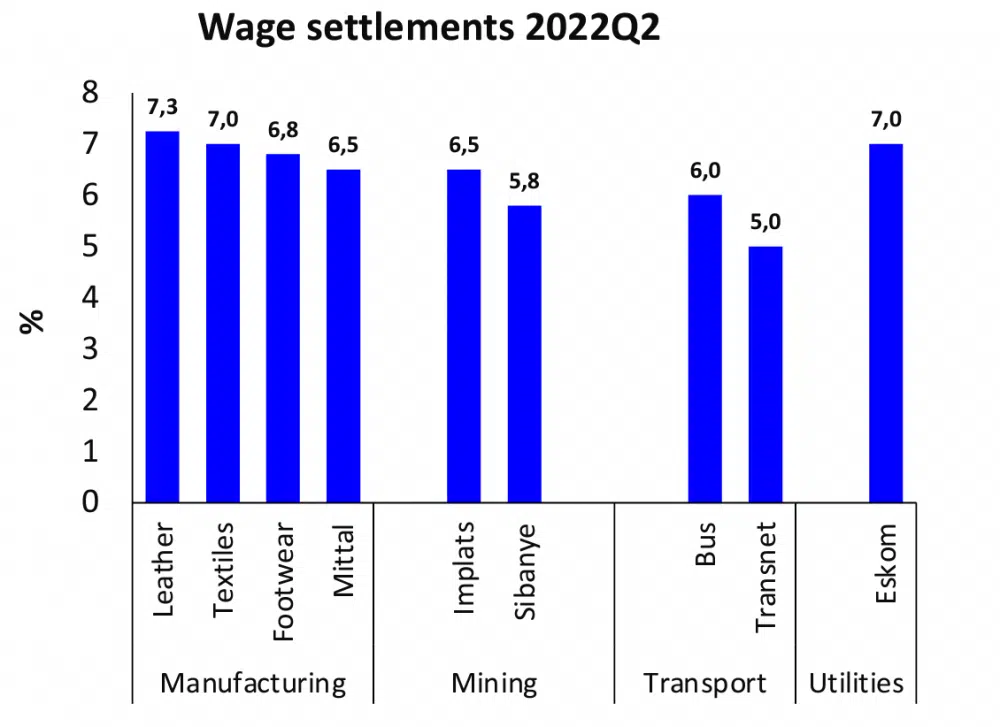

Naidoo added that collective bargaining rates for wages are currently at 6.1%. This compares to the target range of inflation at 4.5%.

This would suggest that the country faces further second-round effects of the high inflation it is currently experiencing, he said. This could prolong the period by which inflation stays high, requiring the central bank to do more to bring it down.

“With increased inflation in the last six months, inflation expectations have gone up; we are quite concerned about that and part of the monetary policy steps we have taken certainly to try to bring inflation expectations back to the mid-range (4.5%),” said Naidoo.

The South African central bank is not alone in tightening monetary policy to curb rising inflation – such as when it raised the repo rate by 75 basis points in July. The SARB reported that inflation had had a similar effect on emerging markets such as India, Brazil and China.

Reporting on real total salaries and wages, Naidoo said that public sector salaries were not as drastically affected by the Covid-19 pandemic, while private sector salaries are sluggish in their return to pre-pandemic levels.

Strike season

South Africa has seen an increase in wage negotiations and strikes over the past few months.

Civil society unions are challenging governments and industries over incremental wage increases. Unions representing nurses, private security companies, the automotive industry as well as public servants have all called for larger salaries amid a rising cost of living.

The Public Servants’ Association (PSA), representing 250,000 public servants, is currently in the process of deciding whether it should strike or not for the first time in twelve years. The PSA is demanding a 6.5% wage increase while the government has only offered 2%.

Recently the National Education, Health and Allied Worker’s Union (Nehawu) joined forces with the PSA to engage in wage negotiations and strike action that left many South African Revenue Services (SARS) branches closed.

Read: Court documents reveal why South Africa has a 5-year driving licence card renewal period