South Africa running out of time to avoid greylisting

South Africa is running out of time to fast-track legislation that could prevent a possible greylisting by the international community, while the rate at which Parliament is moving is raising concern.

Speaking at a standing committee on finance (11 October), Joseph Maswanganyi, the chairperson for the committee, said that the National Treasury must explain why tabling necessary changes to money laundering legislation took so long.

Finance minister Enoch Godongwana recently tabled the Anti-Money Laundering and Combating Terrorism Financing Amendment Bill to try and align the country with some of the recommendations made by the Financial Action Task Force (FATF), but the process behind its refinement has been questioned.

The government is working to avoid a greylisting by the FATF. South Africa received recommendations from the task force, a global organization for establishing standards and supporting anti-money laundering and counterterrorism financing, stretching as far back as the group’s publication of its Mutual Evaluation Report (MER) on the country in October 2021 – a year ago.

The FATF found gaps in critical financial legislation that resulted in abuse and criminal activity. South Africa has until the end of this month, October, to prove to the task force that it has policies to meet the recommendations. A final decision on whether to greylist the country is to be made in February 2023.

The government is, therefore, short on time. Maswanganyi told the standing committee that one could not expect to bring a bill to Parliament and have it be processed in one month – the executive tabled it too late.

Concern has grown over the limited amount of time allocated for public consultation and the possibility that it is being rushed, leading to even more legislative gaps.

During the committee’s procession, industry figureheads such as the Johannesburg Stock Exchange (JSE) said that if the bill was to be passed into law as it stands now, there would be unintended consequences.

A report published by Intellidex, commissioned by Business Leadership South Africa (BLSA), has found that there is an 85% probability that South Africa will be greylisted.

Intellidex said that despite some progress by the government and other institutions to tackle tax crimes, illicit money flows and more – certain areas of implementation of the FATF’s recommendation seem impossible within the specific timeline.

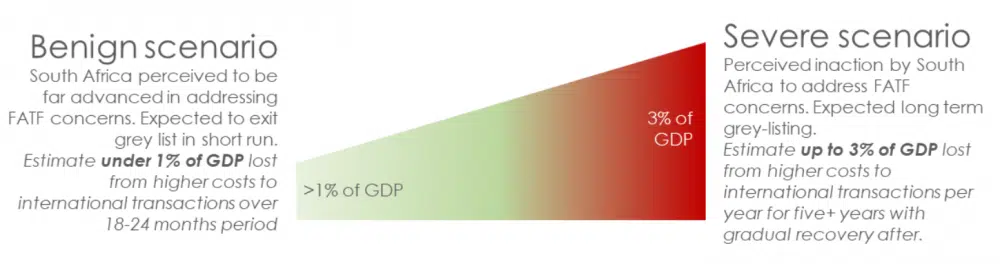

The researchers estimate that the economic impact of greylisting could be limited or severe depending on how South Africa reacts to greylisting. They estimate the impact at under 1% of GDP, “if we act with alacrity to 3% of GDP if South Africa is perceived to be slow and unwilling to meet the standards set by FATF”.

“The economic impact is primarily from the increase in transaction costs for cross-border payments, as well as the general reputational impact. Financial firms around the world, including banks, will be required to apply enhanced due diligence to any South African client, which would mean a more invasive and extensive process of assessing the source of funds and probity of clients,” the researchers said.

They said that the economic impact will depend substantially on how seriously South Africa is perceived to be working toward FATF compliance.

In the view of the authors, there are three critical areas where South Africa has struggled to reach the required levels of compliance:

- The gathering and dissemination of data regarding beneficial owners of trusts and companies. While legislation to this effect is progressing, and the Companies and Intellectual Property Commission has begun preparing to capture such information, the masters’ offices of the high courts have not made progress on an equivalent process for trusts.

- The Directorate for Priority Crime Investigation (the Hawks) has made minimal progress in building the capacity to investigate money laundering and terrorist financing, as well as other commercial crime.

- The Financial Intelligence Centre is envisaged to take on additional supervision responsibilities for the money laundering and terrorist financing oversight of non-financial institutions, including real estate agents, attorney firms, Krugerrand dealers and others. While the legislation to give effect to this is in progress, the additional budgets and resourcing still need to be developed.

Legal expert Steven Powell from ENS Africa has warned that if a greylisting was to occur, the country could expect an average decline in the capital inflow of 7.6% of GDP, a decrease in foreign direct investment of 3% and a decrease in portfolio inflow of 2.9% of GDP.

“Being grey-listed would likely further impair the economy’s links to the global financial system, raise the country’s cost of capital and create an additional disincentive for offshore companies to deal with South Africa,” said Powell.

The National Treasury found that it would take a number of years for South Africa to be removed from the list and could have long-lasting devastating impacts on the economy for years to come.

Read: Warning over high meat prices in South Africa, and why chicken is on the menu right now.