We won’t quibble over claims – just watch out for fraudsters, says Sasria

- While some claims will be examined by heavyweight insurance companies such as Old Mutual Group and Santam, the bulk of the concern will be up to state-owned Sasria.

- Sasria is not contesting the benefits of claims connected to the riots, just looking out for cases of scams, the insurance company states.

- Lots of people and business with Sasria policies might not even understand they are covered.

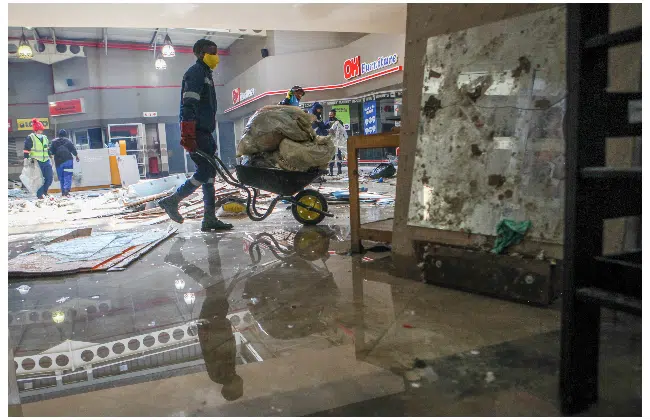

As calm starts to go back to South Africa following days of violent riots that triggered billions of rand in damage, concerns are being asked about who will pay the bill.

While some claims will be examined by heavyweight insurance companies such as Old Mutual Group and Santam, the bulk of the concern will be up to one business: Sasria Insurance.

Sasria, a state-owned company with R8.5 billion in properties under management, was established quickly after the Soweto uprising of 1976, when at least 176 individuals passed away in presentations led by school kids versus the apartheid federal government. The frequency and scale of political demonstrations that followed triggered personal insurance companies to stop using cover to susceptible services, and Sasria was developed to fill deep space.

Sasria is not contesting the benefits of claims associated with the riots, just keeping an eye out for cases of scams, Sasria’s executive supervisor for insurance coverage operations, Fareedah Benjamin, stated in an interview.

Many individuals and business with Sasria policies might not even understand it, as industrial companies frequently include it in their own cover.

All insured people have it along with about 90% of organizations, Benjamin stated.

The business has actually centralised all applications so its the majority of knowledgeable handlers have the ability to process them rapidly.

” We are well capitalised and have sufficient reinsurance in location that provides us the convenience that we can assist in these claims,” Benjamin stated.

The insurance provider has 3 times its regulative minimum capital requirement, she included.

Today’s anarchic robbery and damage of all way of structures in 2 essential provinces has actually thrust the business back into the spotlight. Official quotes of the scale of the damage have yet to be computed, however executives at Business Unity South Africa stated Thursday the variety of afflicted companies might extend into the thousands.

Noted business to have actually reported the degree of their direct exposure consist of foods maker Tiger Brands, which stated it lost R150 countless stock, and clothing seller Mr Price Group, which saw 109 shops totally cleared out and hundreds more closed. However the rampage likewise swept up numerous smaller sized services, lots of in impoverished parts of the seaside city of Durban and Johannesburg, the financial center.

The violence has its origins in presentations versus the arrest of previous President Jacob Zuma, however those picking up a chance to enhance themselves changed the presentations into a robbery spree, the federal government has actually stated. A minimum of 117 of individuals have actually passed away and authorities have actually made practically 1 500 arrests to date.

” We prepare for that in about 2 months’ time, we will have a clearer photo as soon as all claims have actually been reported and examinations and metrology have actually been finished,” Sasria stated in a declaration on Friday.

Santam is keeping an eye on the circumstance and in touch with Sasria about claims, the business stated in an emailed declaration. Old Mutual has actually put unique steps in location to accelerate payments, it stated.

The personal property-and-casualty insurance providers might discover they still have direct exposure even with the Sasria safeguard, stated Warwick Bam, head of research study at Avior Capital Markets.

” Business disruption policies might be set off due to supply-chain disturbance, lost production and shop closures due to the danger of robbery and violence,” he stated.

Sasria gathered R2.4 billion in gross composed premiums and paid R991 million in claims in 2015. In addition to covering public discontent, Sasria is likewise checking out alternatives for Covid-19 insurance coverage as South Africa fights increasing infections and disturbances to its vaccine program.