What to expect from South Africa’s interest rate hike in July: governor

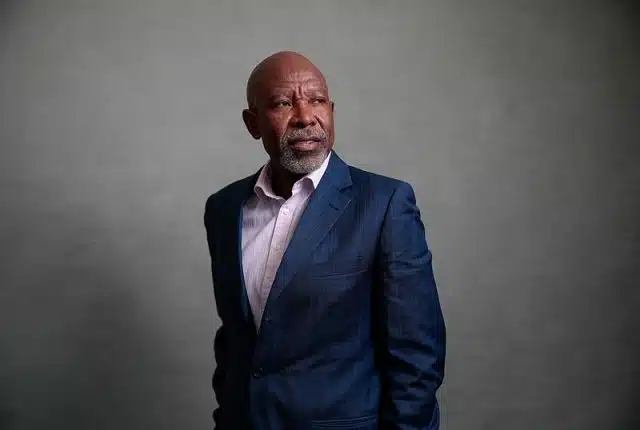

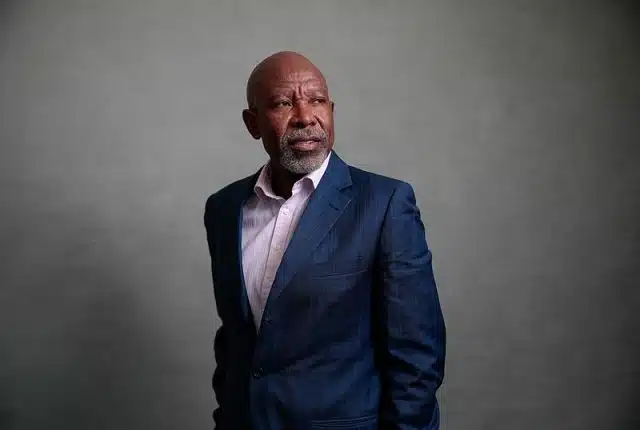

South Africa’s central bank may consider raising its benchmark interest rate by half a percentage point for a second consecutive meeting in July, governor Lesetja Kganyago said.

The inflation rate in Africa’s most industrialized economy surged above the central bank’s target range for the first time in more than five years in May, raising the prospect of policymakers lifting the benchmark interest rate more aggressively this year.

While the baseline scenario is for rate increases of 25 basis points each at its next three meetings this year, the possibility of raising by 50 basis points next month is ‘not off the table’, Kganyago said in an interview with Bloomberg TV on the sidelines of the European Central Bank’s annual policy forum in Sintra, Portugal.

Forward-rate agreements, used to speculate on borrowing costs, are pricing in 63 basis points of tightening at the next monetary policy meeting scheduled for July 21, and more than 180 basis points in total by year-end. That implies at least one 75-basis-point hike at one of the remaining three meetings for 2022.

A three-quarter percentage point increase would be the biggest since September 2002, when the South African central bank lifted the benchmark repurchase rate by 100 basis points.

Read: Consumer confidence in South Africa drops to historic lows: index